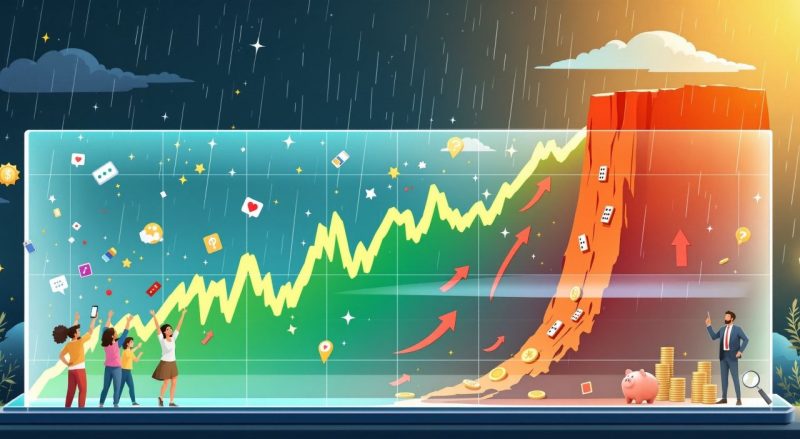

People love a good success story. A stock that rises fast feels like a miracle. It makes normal people think they are smart investors. It gives hope that money can grow without long waiting. When a stock becomes famous, thousands rush in.

Everyone talks about it as if it will rise forever. But hype has a short life. When the noise stops, the fall can be quick and painful.

This is the story of many stocks we have seen in recent years. A fast boom. A loud cheer. Then a deep drop that leaves many confused and broke. It teaches a strong lesson: price is not the same as real value.

The Sweet Sound Of Hype Before The Fall

When a stock becomes the hot topic, more money flows in each day. People do not check what the company sells or if it makes profit. They only see others buying and want to join. They want to feel that joy of winning early. The rush becomes like a game. Some even compare it to moments in slotsgem casino games online, where the screen looks fun and the idea of a big win feels close.

But hype is like music that can stop without warning. When the first drop shows, fear starts. People rush to sell, not to buy. The same crowd that lifted the stock high now pushes it down faster than it climbed. The same friends that said “buy now” suddenly say “I left already”. Let us look at real stories that show how hype can trick even smart adults.

The GameStop Jump And Crash

In early 2021, GameStop turned from a slow store brand into a money dream. Reddit users pushed everyone to buy. Some became millionaires overnight. Many joined because they feared missing out. They thought the rise meant success. But the price was not based on what the company was earning. It was based on people shouting louder than others.

Later, when the hype cooled, the price dropped hard. Those who bought late lost big. This was a loud lesson: if you chase a growing wave without reason, the crash will hit harder.

The Wild Ride Of AMC

AMC was another stock that got too much attention. People said buying it was saving cinemas. It sounded like a mission. It felt fun. But the business itself was still struggling. After the party ended, many saw their money melt. A share that looked like a ticket to wealth turned into a painful bill.

Again, the lesson was clear. A strong story does not mean a strong company. Hype is not a business plan.

The Crypto Company Craze

Many small companies added “crypto” to their names during the crypto rush. Their prices jumped without changing anything real in their work. Just the name alone made investors rush in. A few months later, when excitement dropped, so did the share prices. Hope disappeared. Many people were left asking why they trusted something they did not understand. When a market moves based on feelings and fear, it can fall with the same speed it rises.

Why People Keep Falling For Hype

There are simple reasons. People hate to feel left out. They want to copy others who look like winners. It feels easier than learning facts. When a friend says “This stock is going to the moon”, trust grows faster than math.

Social media also plays a big role. It spreads news in seconds. A rumor can look like the truth because thousands are sharing it. But the truth does not change just because it is loud.

There is also pride. When someone buys a hyped stock, they want to believe they are smart. Selling early feels like giving up. Holding too long feels like courage. Sadly, both can cause loss.

How To Avoid Being Caught In A Boom And Bust

First rule: understand what you buy. A stock is not a lottery ticket. It is a small part of a business. If the business is not doing well, the hype cannot save it for long.

Next rule: look at numbers, not noise. Check if the company is making money. Check if it has real plans. Business facts move slower than hype, but they are more honest.

Final rule: accept that you do not need to be part of every big trend. Missing one rise is better than joining one fall.

The Real Meaning Of A “Bust”

When a stock loses hype, people blame the market. But the truth is simple. The hype was the lie. The fall was the truth coming back. Boom and bust stories teach investors to be patient, calm and wise. They show that long-term success is more stable than fast luck.

Every big crash leaves a lesson behind. If people learn from it, the next hype will be easier to see. If they do not learn, they will keep falling for the next loud promise.

A stock should be judged by its strength, not by its noise. Big numbers on a screen do not always mean a safe future. Real value grows slow but lasts long. Hype grows fast but dies early.