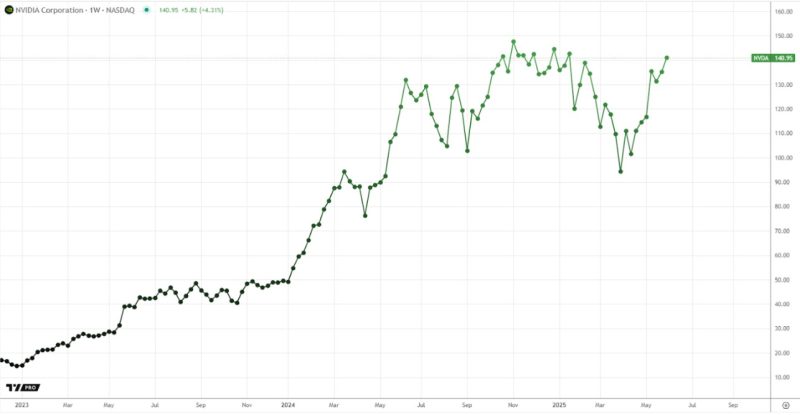

Last week, Nvidia made another breakthrough, once again becoming the most valuable publicly traded company in the world, with a capitalization of $3.45 trillion, surpassing Microsoft ($3.42 trillion) and Apple ($3.38 trillion).

This is not the first shift in leadership among technology giants: since June 2024, Nvidia, Apple, and Microsoft have taken turns at the top, highlighting just how dynamic the market has become in the era of artificial intelligence and semiconductor dominance.

In June 2024, Nvidia surpassed the $3 trillion mark for the first time in history, briefly becoming the world’s most valuable company. This milestone was driven by soaring demand for its graphics processors and impressive financial results. However, it was clear that the competition was just beginning: Apple and Microsoft, with more diversified business models, weren’t backing down.

One of the most notable moments came on January 24, 2025, when Nvidia surged ahead again — though only for a few days. At the time, contracts with major data centers and governments purchases of chips for supercomputers were key growth drivers. The broader sector remains on the rise, and Dow Jones futures reflect traders’ sentiment.

Why is Nvidia back on top?

Nvidia’s recent rise in valuation is related to its first fiscal quarter 2025 earnings report, released last week. The company reported:

- Revenue of $48 billion (120% year-on-year growth);

- Net profit of $28 billion;

- Record shipments of next-generation GPUs, including chips for quantum computing.

Investors responded enthusiastically: Nvidia stock surged to a new all-time high, continuing a year-long rally that has seen the share price more than double. Analysts point out that demand for Nvidia’s AI solutions continues to grow, despite competition from AMD, Intel, Microsoft and Google.

Despite Nvidia’s dominance in AI chips, neither Microsoft nor Apple is ready to concede. Both companies are pursuing different strategies to close the gap and reclaim the title of the world’s most valuable corporation.

Microsoft is aggressively expanding its Azure cloud platform, already a strong competitor to AWS. Built-in AI tools are making it increasingly attractive to business. Moreover, Microsoft has an exclusive partnership with OpenAI, granting it access to advanced language models running on Microsoft servers. Notably, some automated trading platforms already use these AI solutions to generate higher profits.

Apple, meanwhile, is doubling down on its custom chips. The latest generations of Apple Silicon (M4, M5) prioritize machine learning, and the company claims its chips outperform Nvidia’s GPUs in on-device AI tasks. The upcoming iPhone 17 is expected to feature a neuromorphic coprocessor designed to accelerate AI functions without relying on cloud computing.

Although Apple rarely makes large acquisitions, it is actively investing in TSMC and other semiconductor partners to secure access to cutting-edge chip manufacturing.

The semiconductor boom and Nvidia’s future

The semiconductor market is experiencing an unprecedented boom. Since April 2025, the PHLX Semiconductor Sector (SOX) index has jumped 40%, and Nvidia’s valuation has nearly doubled. Still, a key question remains: can Nvidia maintain its leadership?

Microsoft and Apple have enormous cash reserves and are pouring resources in AI chip development, which could hift the competitive landscape. Even so, Nvidia remains a crucial supplier for the AI revolution, and investors continue to bet on its sustained growth.

Nvidia has demonstrated that the hardware era is not over — it has simply evolved into the foundation of a new technological age. The race to be the world’s most valuable company is far from over, and the next shift in leadership could come in just a few weeks.