Update: Trump gives Mexico a 30 day reprive from the tarriffs. Talks with Canada and China to come.

Buckle up, folks, because the global trade landscape just got a whole lot messier. Over the weekend, Trump dropped a bombshell, signing off on sweeping tariffs targeting three of America’s largest trading partners—Canada, Mexico, and China.

And let me tell you, this move is nothing short of reckless. It’s a high-stakes gamble that could send shockwaves through the economy, and the fallout is already starting to take shape.

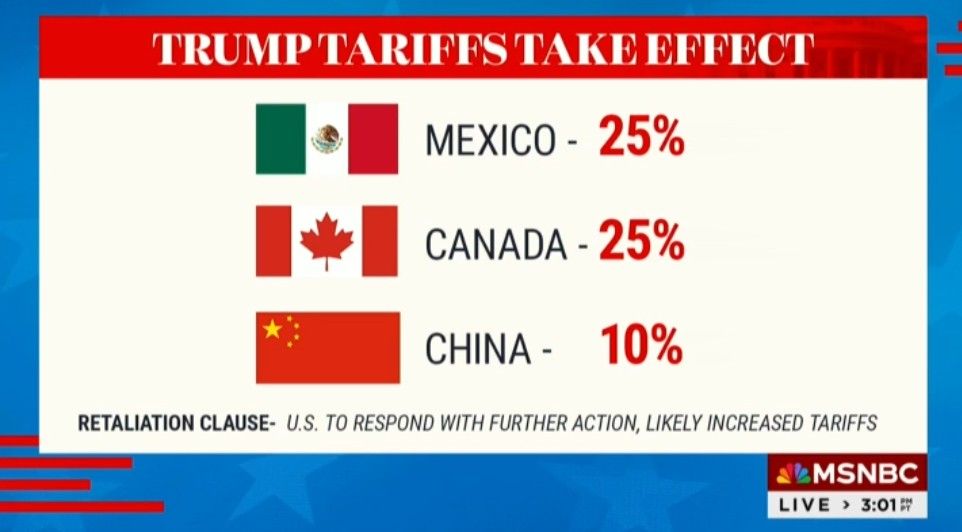

Here’s the deal: starting Tuesday, imports from Canada and Mexico will face a hefty 25% tariff, while goods from China will be hit with a 10% levy. Trump claims this is all about addressing illegal immigration, drug trafficking, and protecting American jobs. But let’s be real—this is a sledgehammer approach to a scalpel problem, and the collateral damage could be massive.

Retaliation Is Coming—And It’s Going to Hurt

Canada, Mexico, and China aren’t taking this lying down. They’ve already announced plans for retaliatory tariffs on U.S. goods, and the numbers are staggering. Canadian Prime Minister Justin Trudeau unveiled a tit-for-tat 25% tariff on $107 billion worth of American products, ranging from beer and wine to household appliances. Mexico is preparing similar measures, and China has vowed to take “necessary countermeasures” to defend its interests.

This is the kind of tit-for-tat escalation that keeps CEOs and investors awake at night. We’re talking about a potential trade war that could disrupt supply chains, drive up costs for businesses, and hit consumers right where it hurts—in their wallets.

The Economic Fallout

Let’s break this down. The auto industry, for example, is staring down the barrel of a loaded gun. Cars and parts cross the U.S., Canadian, and Mexican borders multiple times during production. Slapping a 25% tariff on those goods could add thousands of dollars to the price of a new car. And it’s not just autos—everything from fruits and vegetables to flat-screen TVs is about to get more expensive.

The National Homebuilders Association is warning that housing costs could rise, and the Farmers for Free Trade group says U.S. farmers, already struggling, will be hit even harder. This is a one-two punch to industries that are critical to the American economy.

And let’s not forget about the energy sector. Canadian crude oil, which supplies a significant portion of U.S. refineries, will face a 10% tariff. That could push up gasoline prices, just as Americans are gearing up for summer road trips.

Markets Are Nervous

The markets are already bracing for impact. Futures are pointing to a rough start to the week, with tech stocks and automakers expected to take the biggest hits. Investors hate uncertainty, and this move by Trump has thrown a giant question mark over the global economy. This weekend Crypto markets are feeling it with wild fluctuations in stable coins like Bitcoin and XRP.

The Dow, Nasdaq, and S&P 500 are all likely to open in the red, and international markets are feeling the heat as well. This is the kind of volatility that makes even the most seasoned traders sweat.

What’s the Endgame?

Here’s the million-dollar question: what’s Trump’s endgame? He’s betting that these tariffs will force Canada, Mexico, and China to the negotiating table. But history tells us that trade wars are a lose-lose proposition. The last time Trump went down this road, during his first term, it cost American consumers billions of dollars and left businesses scrambling to adapt.

Trump himself has acknowledged that there could be “some pain” for Americans as a result of these tariffs. But he insists it will all be worth it in the end. “We will Make America Great Again, and it will all be worth the price that must be paid,” he wrote on his Truth Social platform.

The Bottom Line

Look, I get it. Protecting American jobs and addressing issues like drug trafficking are important goals. But this is not the way to do it. These tariffs are a blunt instrument that could do more harm than good. They risk alienating our closest allies, disrupting global trade, and driving up costs for American businesses and consumers.

If you’re an investor, now is the time to tread carefully. Keep an eye on sectors that are heavily exposed to international trade, like autos, tech, and agriculture. And remember, in times of uncertainty, cash is king.

This is a developing story, and the stakes couldn’t be higher. Stay tuned, because this trade war is just getting started—and it’s going to be a wild ride.