Wall Street Journal has revealed what may be the most brazen conflict of interest scandal of the Trump presidency: a top UAE intelligence official secretly purchased a 49% stake in the Trump family’s cryptocurrency company for $500 million, just four days before Trump’s inauguration, months before the administration approved a massive AI chip deal that the Biden administration had blocked over national security concerns.

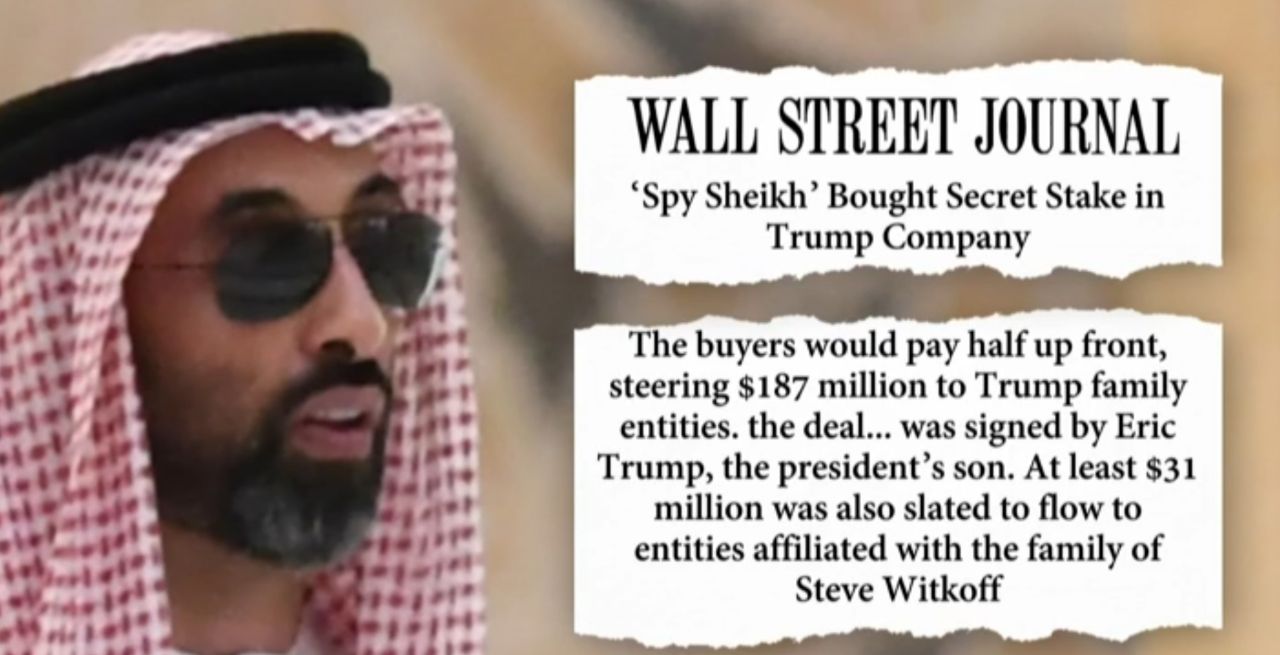

The bombshell report, published Saturday night, documents how Sheikh Tahnoon bin Zayed Al Nahyan, known as the “Spy Sheikh,” orchestrated what the Journal calls an “unprecedented” arrangement: the first time a foreign government official has taken a major ownership stake in an incoming U.S. president’s company.

The $500 Million Deal

According to company documents and sources cited by the Journal, lieutenants to Sheikh Tahnoon, through an entity called Aryam Investment, signed the deal in early January 2025 to purchase 49% of World Liberty Financial, the Trump family’s fledgling cryptocurrency venture.

The deal, signed by Eric Trump, directed $187 million to Trump family entities. At least $31 million was slated to flow to entities tied to Steve Witkoff, Trump’s Middle East envoy whose family co-founded the company alongside the Trumps.

Sheikh Tahnoon is the UAE’s national security adviser, the brother of UAE President Mohamed bin Zayed Al Nahyan, and manages the country’s largest sovereign wealth fund. He also chairs G42, the Abu Dhabi AI company that became a primary beneficiary of the subsequent chip deal.

Then Came the AI Chips

The timing is what turns an already troubling transaction into something far more serious.

In May 2025, just months after the crypto investment, the Trump administration agreed to allow the UAE to purchase 500,000 of America’s most advanced Nvidia AI chips per year, enough to build one of the world’s largest AI data center clusters. Under the deal, 20% of those chips, approximately 100,000 annually, would go directly to G42, Sheikh Tahnoon’s own AI company.

The Biden administration had explicitly blocked Tahnoon’s attempts to obtain this technology, citing national security concerns that the chips could be diverted to China. G42 had previously used Huawei hardware in its data centers, and U.S. intelligence agencies had flagged the company’s ties to Beijing.

Under Trump, those concerns apparently evaporated. President Trump, announcing the deal from Abu Dhabi, repeatedly praised Sheikh Tahnoon, telling UAE President Mohamed bin Zayed about his “wonderful brother.”

The Stablecoin Connection

The financial entanglements run even deeper. World Liberty Financial is behind USD1, a stablecoin pegged to the U.S. dollar. Weeks before the AI chip framework was announced, MGX, another firm controlled by Sheikh Tahnoon, used World Liberty’s stablecoin to complete a $2 billion investment in cryptocurrency exchange Binance.

As part of the January deal, two senior officers at companies backed by Sheikh Tahnoon joined World Liberty’s board, making Aryam the largest outside shareholder of the Trump family’s crypto venture.

‘Corruption, Plain and Simple’

Senator Elizabeth Warren, the top Democrat on the Senate Banking Committee, issued a statement calling for immediate action.

“This is corruption, plain and simple,” Warren said. “The Trump Administration must reverse its decision to sell sensitive AI chips to the United Arab Emirates.”

Warren demanded that Witkoff, White House AI and crypto czar David Sacks, and Commerce Secretary Howard Lutnick testify before Congress “on mounting evidence that they sold out American national security in order to benefit the President’s crypto company, and about whether any officials lined their own pockets in the process.”

“Congress needs to grow a spine and put a stop to Trump’s crypto corruption,” she added.

White House Response

White House spokesperson Anna Kelly told the Journal that “there are no conflicts of interest” and that “President Trump only acts in the best interests of the American public.”

White House counsel David Warrington insisted that “the President has no involvement in business deals that would implicate his constitutional responsibilities,” adding that Witkoff has “divested from World Liberty Financial” and does not participate in official matters that could impact his financial interests.

A World Liberty Financial spokesperson flatly denied any connection between the deal and the AI chip agreement. “Any claim that this deal had anything to do with the Administration’s actions on chips is 100% false,” David Wachsman said. “The leftwing media is dishonestly pushing baseless innuendo in an effort to deceive the public and smear our company.”

Deputy Attorney General Todd Blanche defended the president on ABC’s “This Week,” claiming similar arrangements occurred under previous administrations. “President Trump has been completely transparent when his family travels for business reasons. They don’t do so in secret.”

What Happens Now

The revelations come at a critical moment. Cryptocurrency market infrastructure legislation is progressing through Congress, with Democrats pushing for ethics clauses that would address exactly this type of conflict. Warren and Representative Elissa Slotkin had previously called for an investigation into whether Trump, his family, and senior officials were profiting from foreign crypto deals linked to U.S. technology access.

The fundamental question is stark: Did a foreign government official buy influence over U.S. policy by investing $500 million in the president’s family company? The sequence of events, the secret deal four days before inauguration followed by a national security reversal that specifically benefited the investor’s own company, will test whether any institution in Washington is willing to investigate.

World Liberty Financial launched in September 2024, with Donald Trump Jr. suggesting it would provide opportunities for people who cannot get financing from traditional banks. Trump and Witkoff are now listed as “emeritus” co-founders, while their sons continue to market the company globally, even as the president pushes to make the United States the “crypto capital of the planet.”

At $500 million for a 49% stake in a company that had no products at the time of the investment, the price itself raises questions. What exactly was Sheikh Tahnoon buying?