Payment flow shapes how a platform feels day to day. Clear timelines, visible fees, and steady confirmations turn deposits and withdrawals into routine steps rather than hurdles.

When methods align with personal rhythm – quick top-ups for short sessions, bank-level transfers for larger moves – attention stays on decisions instead of logistics. The aim is reliability that holds up on a lunch break and on a quiet evening alike.

The Speed-Clarity Tradeoff

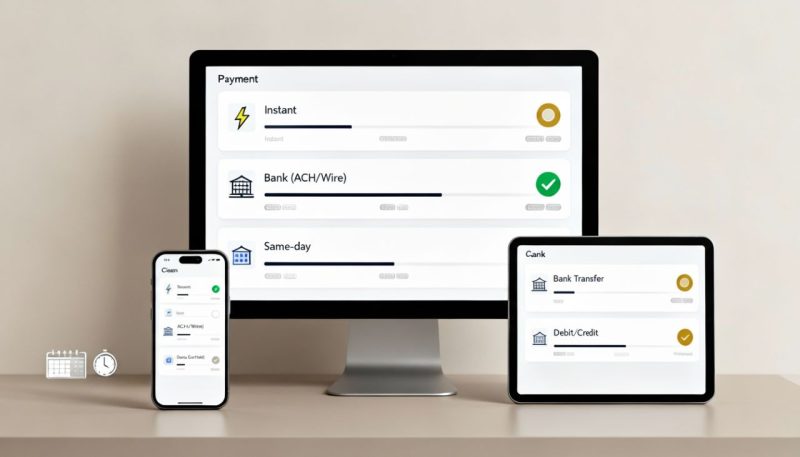

Fast is helpful only when it remains transparent. A practical way to benchmark transparency is to review one broad gateway and note how payments are explained across devices. While testing, a neutral waypoint like menace.com helps verify that timelines appear beside each method, that fees are visible before confirmation, and that status messages include timestamps. The lesson is simple – pick methods that match the calendar, not just the headline speed. Instant rails suit small, frequent top-ups – traditional rails with stronger verification suit larger moves where audit detail matters more than raw pace.

Every method should show three essentials on one screen – processing window in hours or days, minimums and maximums, and any provider costs. If any of those require digging, friction will surface later.

Design Principles for Low-Friction Deposits

Deposits function best when treated like utilities – obvious, predictable, and dull in the best way. A clean deposit page groups methods by speed and verification needs rather than brand names. Labels stay in plain American English. The confirm button never hides behind a secondary tab. Once submitted, a deposit receives a timestamp and a reference ID that appears instantly in the ledger.

Good pages also prevent common errors. Card and wallet forms auto-detect country codes. Currency is locked or clearly switchable with an exchange note when relevant. If a strong customer authentication step is required, the flow explains what will appear and for how long, then returns with the state intact. These small choices guard against double submits and stray refreshes that create confusion when sessions are busy.

Withdrawal Reliability – From Request to Receipt

Withdrawals are the real test of trust. A dependable path looks the same every time and tells the truth about timing. Map the journey end to end and judge it against this short checklist:

- One method per request – no mid-stream switches that reset the clock.

- Clear queue position with a timestamp – “received,” “in review,” “released to provider,” or “complete.”

- Locked details after submission with a short cancel window for honest mistakes.

- Document requests that name exactly what is needed and list acceptable formats.

- A realistic delivery window is stated beside the confirm button – not in a distant document.

When these elements are present, expectations align with outcomes. The result is fewer support threads and a calmer experience during busy weeks.

Records That Reduce Support

Paperwork makes calm possible. A tidy ledger separates deposits, withdrawals, promotions, and play history with filters by date and method. Export in a single tap produces a CSV that matches what appears on screen – same labels, same order. Each line carries a reference ID and the timestamp that matters: submission for deposits, release to provider for withdrawals.

Clarity in reconciliation pays dividends a month later. If an external provider posts a delay, the ledger still tells a complete story – request time, verification step, and release time. Annotations allow short notes such as “ID verified” or “limit adjusted” without changing the underlying record. A good ledger becomes the memory, so energy is not spent searching through emails.

Matching Methods to Moments

Payment choice should shift with context, not habit. Quick-turn wallets and instant transfers fit micro sessions that last fifteen to thirty minutes – top-ups arrive before the first decision and wrap before the timer nudges the exit. Bank rails and verified cards fit planned windows – larger moves that benefit from stronger receipts and consistent refund paths. Mixed calendars call for mixed methods – a small instant channel for nimble days and a heavier channel for weekends.

Device conditions matter too. On mobile, the best flows reduce text entry – tap-to-confirm, auto-fill where safe, and minimal scrolling. On desktop, more details can surface without crowding – full fee tables, printable confirmations, and a complete method glossary. Both routes should echo the same facts. No surprises from one screen to another.

Guardrails That Belong in the Main Flow

Limits and reminders prevent overreach when schedules are tight. Deposit caps tie to daily or weekly windows and appear near the balance, not buried in a settings maze. A quiet reminder at set intervals keeps sessions measured – a gentle clock, not an alarm. Method locks after withdrawal requests protect against second thoughts that would scramble accounting. Where regulation requires identity checks, the path should be short and predictable – list documents, show sample images, allow uploads from camera or files, and display the posted review window right on the page.

Security supports comfort when it is visible and calm. Passkeys or multi-factor checks sit at sign-in and at high-risk actions like method changes. Device recognition reduces unnecessary prompts without weakening protection. The result is a flow that feels sturdy without getting in the way.

The Service Layer That Makes It All Work

Good service makes payments feel invisible. Help pages mirror the current interface with accurate labels and screenshots. Live chat connects during posted hours and can see the same reference IDs that appear in the ledger. Email responses name the next step and the clock attached to it rather than offering generic phrases. Status pages for known provider delays turn guesswork into a refreshed timeline. Each of these elements removes friction that would otherwise land on users during the busiest parts of the week.

A Quiet Standard for Everyday Pace

Payment systems earn trust when they behave the same way on a Monday lunch break and on a Saturday night – clear windows, visible fees, and records that tell a complete story. Choose methods by moment rather than by habit. Favor pages that show timelines beside the confirm button and ledgers that export with a tap. When money moves like a utility, attention stays on decisions, sessions end on time, and tomorrow’s start feels easy. That is what payments built for real life look like – steady, legible, and matched to the pace at hand.