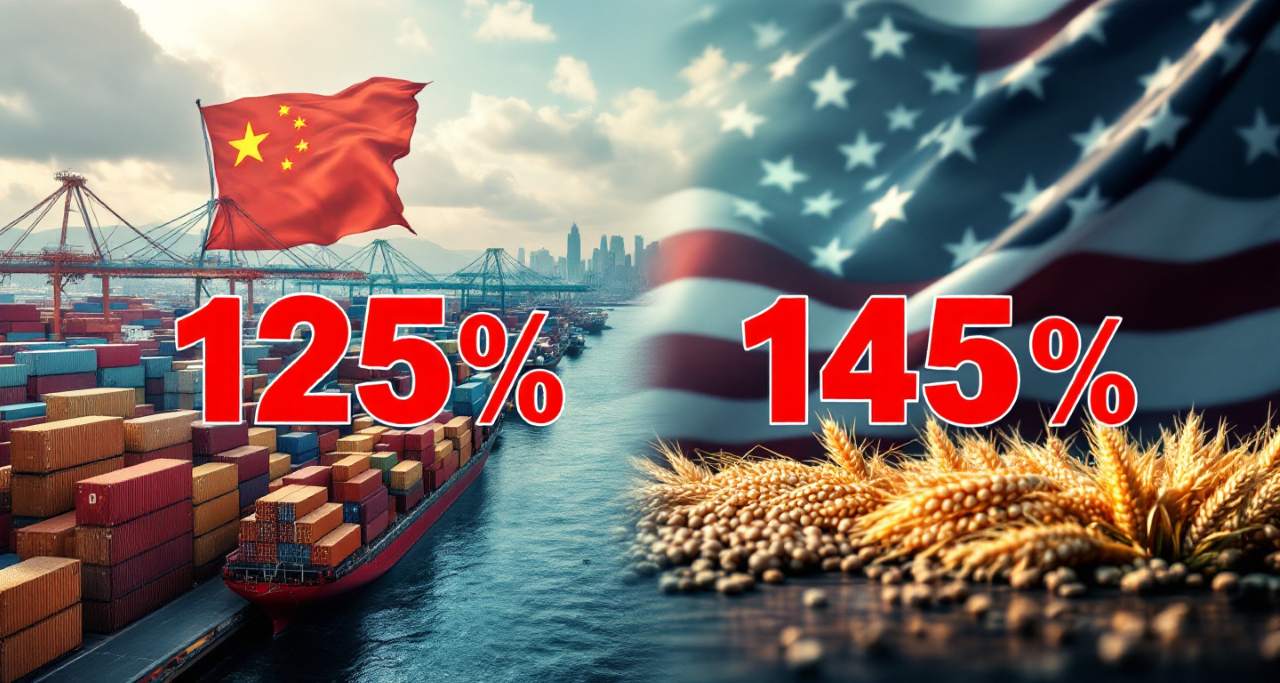

In a dramatic escalation of the ongoing trade war between the world’s two largest economies, China announced Friday it will raise tariffs on US goods from 84% to 125%.

This bold countermeasure comes in direct response to the Trump administration’s recent decision to hike duties on Chinese imports to a staggering 145%.

A Tit-for-Tat Trade Battle Reaches New Heights

The Chinese Finance Ministry didn’t mince words in its announcement, calling Washington’s repeated tariff increases “a joke in the history of the world economy.” The statement went further, warning that “if the US insists on continuing to substantially infringe on China’s interests, China will resolutely counter and fight to the end.”

This latest salvo marks the third retaliatory measure from Beijing in an increasingly heated economic confrontation that has rattled global markets and raised fears of a worldwide economic slowdown.

“There are no winners in a tariff war,” Chinese President Xi Jinping declared Friday, speaking publicly on the matter for the first time. His comments came as China’s Commerce Ministry announced it would file another lawsuit with the World Trade Organization against the US tariffs.

How Did We Get Here?

The path to these unprecedented tariff levels has been swift and steep. In February and March, the Trump administration imposed a combined 20% tariff on Chinese goods over its alleged role in the international flow of fentanyl precursors. By early April, citing the US trade deficit with China, Trump announced an additional 34% tariff.

China quickly matched with its own 34% levy on American goods. The situation spiraled when Trump threatened—and then implemented—an additional 50% tariff if China didn’t rescind its measures, bringing the US total to 104%. China responded by matching Trump’s 50% increase, raising its total to 84%.

The escalation continued Wednesday when Trump further increased the US tariff to 125%, which the White House later clarified didn’t include the earlier 20% fentanyl-related tariffs, bringing the actual total to 145%. Today’s Chinese response of 125% appears to be matching the tariffs Trump has imposed since last week.

Economic Impact and Market Reaction

The trade war has sent shockwaves through global markets. The US dollar tumbled to a three-year low against the euro and hit its lowest rate against the Swiss franc in a decade, undermining its status as a safe-haven asset. Meanwhile, gold—traditionally a refuge during economic uncertainty—surged past $3,200 an ounce, reaching an all-time high.

Wall Street’s main indexes have experienced significant volatility, with the S&P 500, Dow Jones, and Nasdaq all showing substantial fluctuations throughout the week.

Economists warn that these hefty tariffs could reheat inflation and potentially trigger a recession as producers face higher costs that will likely be passed on to consumers. Industries from agriculture and food to planes and semiconductors could suffer massive financial losses in the US, potentially leading to downsizings and closures.

What’s Next?

Despite the heated rhetoric, China signaled that this might be its last tariff increase for the moment. “Given that, at the current tariff level, US exports to China are no longer commercially viable, China will not respond to any further tariff hikes by the US on Chinese goods,” the government stated.

The Commerce Ministry dismissed Trump’s escalating tariffs as a “meaningless numbers game” with “no real economic significance,” suggesting that if the US continues to raise tariffs, “China will ignore it.”

Trump, for his part, remains bullish on his trade policy. In a post on his social media platform Truth Social, he claimed the US is “doing really well on our tariff policy,” adding that it is “very exciting for America, and the world!!! It is moving along quickly.”

However, the president has acknowledged that his tariffs will pose “transition problems” even as he maintains they will ultimately benefit the United States.

As the world’s two largest economies continue this high-stakes economic confrontation, the global implications remain profound. The head of the WTO, Ngozi Okonjo-Iweala, warned earlier this week that the trade war between the US and China “could severely damage the global economic outlook.”

With tariffs now at levels that make trade between the two nations practically unfeasible, the question remains: who will blink first in this economic game of chicken?