In a big win for President Joe Biden and the American people, the Senate on Sunday afternoon approved the $750 billion health care, tax, and environment measure proposed by Democrats.

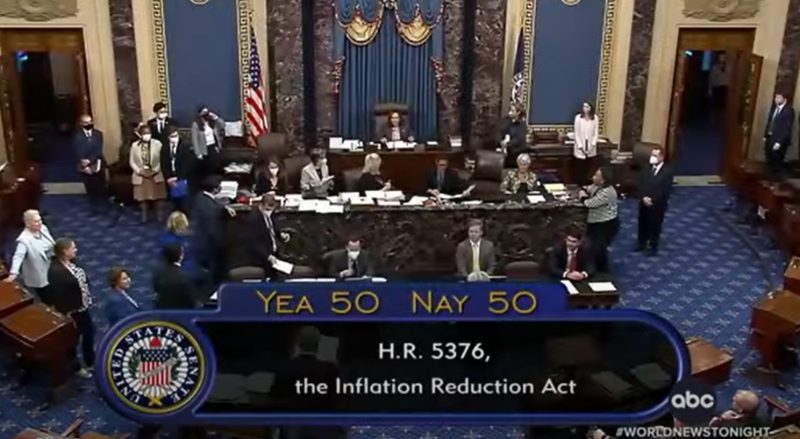

On a party-line basis, the final vote was 51–50, and Vice President Kamala Harris broke the deadlock. The plan is the result of arduous talks, and if it is approved, Democrats will have a chance to advance significant legislative goals before the next midterm elections.

The Senate released THIS ONE PAGE SUMMARY of the bill

Before Biden can sign the bill into law, the Democrat-controlled House, which is anticipated to take up the legislation on Friday, August 12, must pass it.

The Inflation Reduction Act, as it is known, would prolong expired health care subsidies for three years in addition to being the most significant climate investment in US history. It would also significantly alter Medicare’s ability to negotiate the cost of some prescription medications. The measure would increase the Internal Revenue Service’s ability to collect taxes while reducing the deficit and paying for itself through additional levies, such as a 15% minimum tax on major firms and a 1% tax on stock buybacks.

Over a ten-year period, it would generate over $700 billion in additional tax income for the government, of which over $430 billion would be used to cut carbon emissions and prolong subsidies for health insurance under the Affordable Care Act. The remaining funds would be used to lower the deficit.

A unique, filibuster-proof procedure was used to pass the bill without the support of Republicans by Senate Democrats, who had a slim 50-seat majority. Final approval after a protracted, controversial “vote-a-rama” that lasted for about 16 hours, from late Saturday night to early Sunday day.

Sen. Joe Manchin, a Democrat from West Virginia, told CNN that the plan is “a well-balanced package.”

Manchin was quoted as saying, “I think we’ll all profit from it; the country will.” “We found the energy security we were seeking for. Additionally, we have the means to finance the energy of the future.”

In a statement released on Sunday, Biden applauded the Senate for approving the package, thanked the Democrats present, and highlighted the bill’s investments in the environment and health care provisions.

Senate Democrats have long intended to enact a landmark piece of legislation that would include important party agenda items. Still, they have battled for months to come to an agreement that would have the backing of their whole caucus.

Manchin was instrumental in drafting the measure, which only advanced after a compromise was unveiled by the West Virginia Democrat and Senate Majority Leader Chuck Schumer at the end of July. This was a significant victory for Democrats after earlier talks had faltered.

Sen. Kyrsten Sinema of Arizona said she will “go forward” with the comprehensive economic plan on Thursday night after party leaders agreed to modify new tax measures.

However, Sinema, Manchin, and other senators worked all weekend to make significant changes to the plan.

Democrats came up with a strategy to appease Sinema, who was worried about the effects of the 15 percent corporate minimum tax on subsidiaries owned by private equity, in order to prevent a last-minute collapse of the package on Sunday. Senate Republicans’ Whip John Thune of South Dakota suggested changing the state and local tax (SALT) deduction to pay for a narrower tax proposal that Senate Democrats accepted, but they chose to increase the cap on the amount of losses that businesses can write off for an additional two years instead of doing so.

When the House votes on the package later this week, the modification was made to stop House Democrats, mostly from coastal areas, who have campaigned in favor of lifting restrictions on the SALT deduction, from voting against it.

Influential House Democrats said later on Sunday that they would support for the package despite earlier objections on SALT, which is encouraging for its passage.

New Jersey congressman Josh Gottheimer once belonged to the “No SALT, no agreement” faction. But he said that because it doesn’t increase the rates for individual income taxes, the package meets his litmus test.

Another member of the caucus, Rep. Mikie Sherrill of New Jersey, shared his sentiment: “Additionally, I’ll continue to do everything in my power to make sure that any debate on changes to the 2017 tax code starts with a discussion of SALT. I’ll vote in favor of this measure since it drastically reduces costs for households in my district rather than raising taxes on them.”

Republicans exploited the weekend’s “vote-a-rama” to pressure Democrats into making difficult decisions. They also succeeded in getting a crucial insulin provision eliminated, which the Senate parliamentarian said did not follow the Senate’s reconciliation rules and would have limited the cost of insulin to $35 per month on the private insurance market. For Medicare beneficiaries, the $35 insulin limit is still in effect.

The package, according to Senate Minority Leader Mitch McConnell, “includes huge job-killing tax rises” and amounts to “a assault on American fossil fuel,” he said in a statement. Republicans in Kentucky claimed that Democrats “do not care about the interests of middle-class households.”

And they’ve responded to the out-of-control inflation they’ve produced with a measure, according to experts, that won’t even remotely reduce inflation, McConnell added. “The priorities of the American people are obvious. Environmental regulation accounts for 3% of all problems. The United States wants answers for the border, crime, and inflation.”

Even if analysts are divided on whether the package would actually live up to its name and lower inflation, especially in the near term, it would have a significant influence on lowering carbon emissions.

The largest climate investment in US history and the biggest success for the environmental movement since the historic Clean Air Act is the approximately $370 billion clean energy and climate package. It also comes at a crucial moment since this summer, the nation has seen fatal floods and harsh heat waves, both of which experts attribute to a warming world.

According to analysis by Senate Majority Leader Chuck Schumer’s office and other independent evaluations, the proposal may cut US carbon emissions by up to 40% by 2030. To achieve President Joe Biden’s aim of reducing emissions by 50% by 2030, strong climate policies from the Biden administration and state-level action are required.

The law also includes a number of tax incentives designed to lower electricity costs by utilizing more renewable energy sources and encourage more American customers to use electricity to power their homes and automobiles.

According to lawmakers, the measure is a significant accomplishment and only the beginning of what is required to address the climate catastrophe.

Sen. Brian Schatz of Hawaii, a Democrat, said to CNN, “This isn’t about the laws of politics, this is about the principles of science.” We were all aware going into this attempt that we had to follow the directions provided by the science.

The proposed legislation would give Medicare the authority to bargain for lower rates on some expensive pharmaceuticals that are prescribed by doctors or purchased from pharmacies. The secretary of health and human services would haggle over the costs of 10 medications in 2026, 15 more in 2027, and once more in 2028. For 2029 and after, the number would increase to 20 medications annually.

Compared to the problematic clause that House Democratic leaders previously supported, this one is far more constrained. However, it would pave the way for achieving a long-standing party objective of enabling Medicare to utilize its considerable influence to reduce prescription costs.

Democrats also intend to continue the improved federal premium subsidies for Obamacare coverage through 2025, which is one year later than recently anticipated by Congress. They wouldn’t pass away immediately following the 2024 presidential election that way.

The measure would levy a 15 percent minimum tax on the income that big businesses report to shareholders instead of the Internal Revenue Service in order to increase revenue. The plan would apply to businesses with income exceeding $1 billion and raise $258 billion over the course of ten years.

Sinema has stated that she changed the Democrats’ plan to limit how firms may deduct depreciated assets from their taxes because she was worried about how this measure would effect some industries, notably manufacturers. The specifics are still hazy.

The carried interest loophole, which lets investment managers classify a large portion of their salary as capital gains and pay a 20 percent long-term capital gains tax rate rather than an income tax rate of up to 37 percent, was targeted for closure by Sinema, but she rejected the proposal.

The clause would have increased the time period from three to five years during which investment managers’ profit interest must be retained in order to benefit from the reduced tax rate. Democrats in Congress had long sought to close this loophole, which would have generated $14 billion over ten years.

A 1 percent excise tax on stock buybacks by firms was introduced in its stead, earning an additional $74 billion, according to a Democratic aide.