Biden reassured investors and the public that a regulatory takeover of two failed banks and the rescue of their depositors, along with recently implemented safeguards, would be sufficient to prevent a wider crisis in the financial system.

President Biden proclaimed the underlying banking infrastructure “safe and secure” from aftershocks caused by the tragic run on Silicon Valley Bank as equities launched a tense day of trading that resulted in significant losses for some regional banks, including San Francisco-based First Republic.

“The American people can trust that the banking system is secure. Before departing for a three-day tour to California and Nevada, Biden made remarks at the White House. “Your deposits will be there when you need them.

Venture capitalists and hedge fund managers largely praised the plan to guarantee deposits at Silicon Valley Bank and Signature Bank by invoking a “systemic risk exception,” which permits regulators to backstop even deposits too large to qualify for federal insurance, after a weekend spent warning of domino effects and mass layoffs.

Garry Tan, CEO of Silicon Valley startup accelerator Y Combinator, tweeted, “The #1 thing we should be thankful for is decisive action by the US Government at every stage of this: the White House, Treasury, FDIC, the Fed, Congress, and California leaders who stepped up large.

A new tool was also included in the strategy unveiled by the U.S. Treasury, Federal Reserve Bank, and Federal Deposit Insurance Corp. to stop the spread of bank failures. Under its terms, banks with balance sheets constrained by high interest rates will have access to liquidity in the form of loans from the Fed secured by their impacted assets.

As part of the FDIC’s acquisition of Silicon Valley Bank, the bank’s top executives were ousted, and Tim Mayopoulos, a software executive who helped mortgage guarantee giant Fannie Mae survive the financial crisis and led it from 2012 to 2018, was named CEO. According to Bloomberg, financial regulators are already examining whether Silicon Valley Bank, based in Santa Clara, carried out the necessary planning and stress testing as the Fed began to hike interest rates last year.

Despite ongoing concerns about the stability of the financial sector, the stock market as a whole seems unconcerned, closing Monday’s trade practically flat.

Markets, however, took some time to rule out the prospect that liquidity problems may arise at other medium-sized banks, endangering the investors and depositors of such institutions and spreading the economic ripple effect. Bank stocks fell 7.7% on Monday to their lowest level since June 2020, a moderate shock to the banking sector.

Medium-sized businesses with wealthy clientele, like Silicon Valley Bank’s, took a beating. The First Republic Bank was the hardest hit. Even though First Republic Bank officials claimed there was no liquidity problem, its stock fell 62% on Monday.

That hasn’t been decided in full yet. Silicon Valley Bank’s business strategy is comparable to that of First Republic. Both of them experience asset markdowns as interest rates rise, and they both cater to the lucrative market of Silicon Valley entrepreneurs, executives, and businesses. However, First Republic relies less on the banking operations of individual startup companies and has a far larger portion of its assets in jumbo mortgages on expensive residences.

Since late last week, regulators have been working extra hours. During a day in which clients sought to withdraw $42 billion in cash, Silicon Valley Bank was taken over by the FDIC on Friday. As of the end of 2022, the bank had more than $200 billion in assets. The biggest failure since 2008 was it. After that, officials closed down Signature Bank over the weekend after deciding that it also posed a systemic danger.

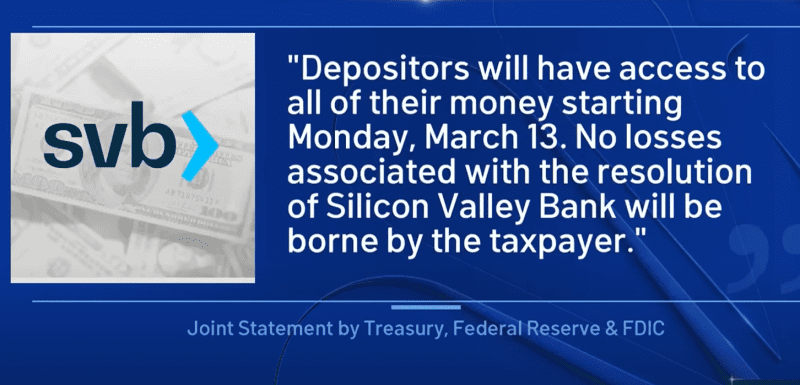

The Treasury Department announced on Sunday that customers at both banks, including those who had funds in excess of the $250,000 federal insurance limit, would have access to their funds starting on Monday despite the fact that no buyers were immediately ready to take over their assets and liabilities.

In his remarks on Monday, Biden said that the fees that banks pay into the federal Deposit Insurance Fund will cover the costs rather than being covered by taxes.

Along with promising to hold those culpable, Biden stated that the bank’s shareholders would not be protected.

Biden attributed the bank failures to former President Trump’s move to relax banking regulations in 2018 that were put in place in the wake of the 2008 financial crisis.

Biden stated, “Unfortunately, the previous administration pushed back rules.

The Trump declared he will approach Congress and bank watchdogs to request the reinstatement of the Obama-era regulations.

Sen. Elizabeth Warren (D-Mass.), one of the party’s most liberal legislators, said that the 2018 revisions to the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act would put “American consumers at greater risk.”

Republicans joined 16 Senate Democrats and independent Angus King of Maine in supporting the measure. King typically votes with Democrats. In the House, all but one Republican and 33 Democrats voted in favor of the proposal. Among the Republicans who supported the bill were Florida Governor Ron DeSantis, a potential 2024 presidential candidate who was a member of the House at the time.

Despite strong bipartisan support for Monday’s rescue of Silicon Valley Bank and Signature Bank customers, several Republicans seized the occasion to criticize the Biden administration for what they termed a “bailout.” These included Josh Hawley, a senator from Missouri, and Nikki Haley, a candidate for president.